Rare Earth Magnet Industry Insights

— Market Report

China 2025 Rare Earth Production Quotas

2025-08-20

Overview

On August 15, 2025, China issued its first batch of rare earth mining, smelting, and separation production quotas for the year. While the specific quota figures were not publicly disclosed, industry sources indicate that the targets were delivered internally to major state-owned producers, signaling a continuation of China’s total control policy over the rare earth supply chain.

China’s 2025 Rare Earth Quota Policy Background

On August 15, 2025, China released its first batch of rare earth production control targets to China Rare Earth Group and Northern Rare Earth Group. Unlike previous years, the official quota figures were not publicly announced, and based on current policy trends, they may remain undisclosed.

Industry analysts believe that China’s rare earth production quotas in 2025 are likely to see a moderate increase compared with 2024, reflecting both strategic resource management considerations and growing downstream demand from sectors such as electric vehicles, wind power, and high-efficiency motors.

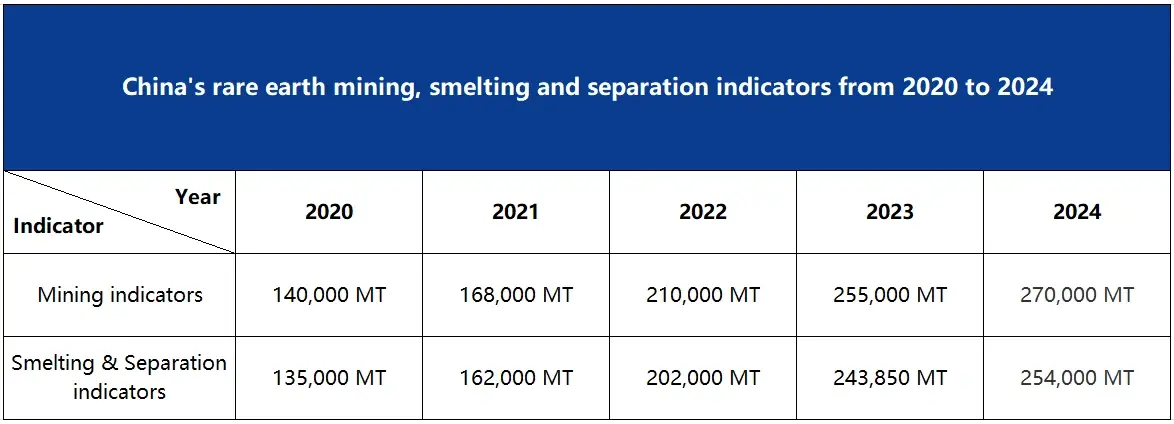

Rare Earth Mining, Smelting, and Separation Quotas: Five-Year Trend

Despite the lack of disclosure for 2025, publicly available data from the past five years provides a clear reference for understanding China’s quota trajectory:

Historical Quota Data (2020–2024)

2020

Mining: 140,000 MT

Smelting & Separation: 135,000 MT

2021

Mining: 168,000 MT

Smelting & Separation: 162,000 MT

2022

Mining: 210,000 MT

Smelting & Separation: 202,000 MT

2023

Mining: 255,000 MT

Smelting & Separation: 243,850 MT

2024

Mining: 270,000 MT

Smelting & Separation: 254,000 MT

This steady upward trend highlights China’s approach of controlled expansion under a total quota management system, balancing supply security with environmental and regulatory objectives.

Implications for the Global Rare Earth Market

China’s 2025 rare earth production quotas will remain a critical factor shaping global supply expectations. Even without full disclosure, quota management continues to influence pricing, export availability, and long-term procurement strategies for international buyers.

For downstream industries, understanding quota trends is essential for assessing supply risks and planning sourcing strategies amid ongoing geopolitical and regulatory developments.

Conclusion

China’s 2025 rare earth production quotas reinforce the country’s long-standing total control framework over mining, smelting, and separation activities. While the exact figures remain undisclosed, historical data suggests continued growth under tighter regulatory oversight, with significant implications for the global rare earth market and industrial supply chains.

📌 Stay tuned to MAGSEES – the rare earth magnet portal for the In-depth industry insights !